During the Aspida&dForce LSD Vault Campaign AMA, attendees raised some of the most pressing questions that captured the essence of the discussion. Here are the top questions that stood out from the event:

What is the motivation for the team to build the Aspida project?

As an asset protocol, Aspida features easy conversion, transferability across multiple chains, and no limitation on the amount of funds.

Ever since the Merge shift Ethereum from PoW to PoS, Aspida had leveraged the future of Liquid staking and aimed to provide a safe and decentralized staking option for the market. While we are exploring the Distributed validator technology (DVT) application by SSV network and Obol network, as well as LSDfi war & LRT growth, we find it’s a proper time to join the battle of LSD.

What is Aspida?

Aspida is an efficient liquid staking protocol built on Ethereum that offers a decentralized, secure, and highly compatible staking service. By leveraging the power of liquid staking, Aspida allows users across different layers and networks to earn profitable rewards while maintaining the flexibility to participate in multiple staking opportunities.

Aspida offers a range of features that set it apart from other staking protocols.

- User’s Efficient Staking Experience: Aspida strives to create a seamless and user-friendly staking experience.

- Enhanced Flexibility: Aspida provides users with the freedom to stake their assets across different networks and layers. This flexibility allows users to diversify their staking portfolios and maximize their earning potential.

- Dynamic Yield Optimization: Aspida utilizes advanced algorithms and unique interaction designs to optimize the yield generated from staking activities.

- Robust Security Measures: Aspida prioritizes security and ensures the safety of users’ assets.

- Seamless Interoperability: Aspida is designed to be highly compatible with different networks and protocols. This interoperability enables users to stake their assets across multiple networks, ensuring they can take advantage of the best staking opportunities available.

How does Aspida work?

Users pledge their ETH assets or stETH assets through the Aspida protocol and receive aETH tokens. Aspida includes stETH as part of a liquidity pool, forming a trading pair (stETH, aETH), allowing users to make instant exchanges. By depositing aETH into a staking contract, users will receive saETH along with the accumulating yield generated from the staked ETH.

Simultaneously, Aspida batches user ETH tokens for staking with validators and routes the staking packages to network staking contracts.

Detailed explanation of aETH&saETH

Aspida’s ETH LSD consists of two tokens.

The first is aETH, a wrapped ETH token minted at a 1:1 ratio with ETH.

The second is saETH, which is minted by staking aETH into a staking contract. saETH serves as a yield token, representing the accruing staked ETH yield.

aETH constitutes the deposit certificate of the native ETH token, can be minted with ETH at 1:1 ratio and withdrawn into native ETH via unstaking or users could simply exchange between aETH/ETH via Aspida’s native liquidity module. In addition to ETH, Aspida currently accepts stETH (Lido LST) to mint aETH, thereby improving the conversion efficiency of user assets. Whether stETH will continue as a minting channel in the future, or if more LST will be accepted, will be decided by Aspida DAO governance. You can use aETH in DeFi applications such as lending protocols in the market just like stETH.

saETH is a staking certificate issued by Aspida staking tokens, an ERC-4626 compliant vault that is minted upon aETH staking. Users are required to stake their aETH into saETH in order to capture Ethereum’s staking yield. This results in structural liquidity yield, where staking yield is only provided to those who have staked aETH into saETH. As a result, saETH holders receive a structural leveraged yield, which is higher than the native staking yield (the more aETH non-staked, the higher the saETH yield). Simultaneously, the returns accrued through the validator will be converted into an equivalent quantity of saETH added to the vault. Through this restake modality, stakeholders can convert a greater quantity of saETH. You can use saETH in DEX & L2 vault in the market just like wstETH.

Introduction of Aspida-dForce joint incentive campaign

This campaign is scheduled to kick off on February 1, 2024 for a duration of 38 days. During this period, participants are invited to forge saETH asset by depositing ETH or wstETH through the Aspida-dForce LSD Vault on Arbitrum.

As a gesture of gratitude for all participation, we are pleased to offer great rewards. Participants will have the opportunity to earn $ARB and Shield points. One standout feature of this campaign is its remarkable flexibility. There’s no minimum deposit requirement.

During Lockup period, those who deposited ETH and wstETH in the Vault, will be able to claim respective saETH at system exchange rate (set at the time of lockup), after lockup expires (for about 10 days), users will be able to claim saETH.

Aspida extends a warm invitation to all participants to seize this unique opportunity.

What’s the whole process of the campaign?

We divided the campaign into 2 parts, Free Staking Phase (including Bonus Pool) and Lockup Phase.

Free Staking Phase

- Duration: 28 days.

- Participants are free to make wstETH and ETH deposits and withdrawals. However, those users who make withdrawal during this period will not be eligible to claim rewards from Bonus Pool.

- The incentive amounts will be updated on a weekly basis.

Bonus Pool

- Rewards will be accrued during the Free Staking Phase and distributed in the Lockup Phase.

- Only users who have not made any withdrawal during the Free Staking Phase are eligible to receive incentives from the Bonus Pool.

- Users exit prior to Lockup Phase will forfeit their bonus rewards and users who roll into Lockup Phase will be eligible to claim all rewards in the Bonus Pool (including those forfeited rewards from exited users).

- The incentive amounts will be updated on a weekly basis.

Lockup Phase

- Duration: 10 days following the conclusion of the Free Staking Phase.

- (1) All Lockup Phase participants are eligible to receive the final phase incentives, including those who do not qualify for Bonus Pool incentives.

- (2) New deposits or withdrawals are not allowed during this phase.

- (3) saETH Conversion: wstETH and ETH in the vault will be converted into saETH upon Lockup expiry, the wstETH/saETH exchange rate snapshot will be taken at 12:00am UTC on March 9, 2024.

- At the end of the Lockup Phase, Participants are able to claim their incentives, including $ARB and Shields, as well as the saETH.

*The (wst)ETH withdrawal will be available again once the Lockup Phase ends on March, 9th.

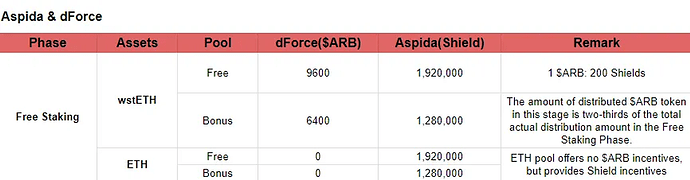

What is the rewards distribution for this campaign?

All participants with wstETH deposited will receive dual incentives in the form of both $ARB and Shields: for every $ARB earned, they will also receive 200 Shields. (ETH Pool only provides Shield incentives and does not offer $ARB incentives.)

What are Shields?

Shields symbolize the individual participation of each user in the Legendary, which will be redeemable for $ASP tokens at the TGE (Token Generation Event).

What’s the distribution of the reward of $ARB & Shields?

Distribution of $ARB Incentives

- The initial allocation is 16,000 $ARB tokens in the first week (Jan 1st — Jan 8th 2024), and the incentive amounts will be regularly reviewed and updated on a weekly basis.

- 60% of incentives will be allocated to the Free Staking Phase (equivalent to 9,600 $ARB);

- The remaining 40% (equivalent to 6400 $ARB) will be accumulated in the Bonus Pool for distribution according to the rules during the Lockup Phase.

Distribution of Shields Incentives

- wstETH Pool: A total of 3,200,000 Shield will be allocated as incentives for the first week, distributed at a rate of 1 $ARB token to 200 Shield across different activity phases.

- ETH Pool:

User Shields Rewards = (User ETH Staked/Total ETH Staked) * Distribution Rate

The amount of Shields received per second will be based on the users’ staked ETH.

The Shield reward is calculated by their share of funds (the percentage of a user’s staked amount vs total staked) multiplied by the distribution rate (shields allocated per second).The distribution rate per second is determined based on the total number of shields allocated weekly.

What’s Aspida’s next step of plan after the vault campaign?

In March we will start the official launch of Aspida mainnet with Shields incentives.

When does the vault campaign end?

March 9, 2024.

Does Aspida have thought about Bug bounty?

Yes. The Aspida Bug Bounty Program is set to kick off on February 21, 2024. Participants can report bugs and earn rewards via the Immunefi platform at: Aspida Bug Bounties | Immunefi. The rewards will vary depending on the severity of the detected bug.

Does Aspida have an audit report yet?

Yes, we had audited with Mixbyte and you can check the audit report through both sides’ GitHub. Click here to check the details.

Describe the security of using Aspida?

Aspida offers a comprehensive range of security features aimed at mitigating users’ exposure to slashing risks. Here are key aspects that underline the safety protocols of Aspida:

-

Aspida owns security measures;

-

Aspida protocol is non-custodial, minimizing counterparty risk;

-

Aspida’s codebase is open-source;

-

Aspida pledges ongoing audits of smart contracts;

-

Aspida minimizes stakers’ staking risk through its cohort of veteran node operators.

Is Aspida set to achieve any milestones, follow a roadmap, or unveil future plans this year?

Aspida is gearing up for the Official Mainnet launch in Q1, L2 deployment scheduled for March, with Liquid Restaking (LRT) and integration with Eigenlayer in the pipeline.

Where can I go to join Aspida’s community or learn more about Aspida?

You can connect with us through various platforms:

- Visit our website: Aspida Website

- Follow us on Twitter: @aspida_net

- Join our Telegram group: Aspida Telegram

- Ask questions in our Discord server: Aspida Discord

- Explore our blog: Aspida Blog

- Contribute to our codebase on GitHub: Aspida GitHub